Bitcoin Bulls and Bears

Digital art collectibles

Commemorative NFTs:

- Bitcoin Bulls and Bears NFTs are digital collectibles created by real-world artists and issued monthly to commemorate key crypto market events and project launches since the birth of Bitcoin in 2008 and the launch of Bitcoin trading in 2010.

Digital Art Collectibles:

- Monthly issuance of unique digital collectibles

- Created by real-world artists from around the globe

- Commemorating key events in the history of crypto currency

- Available number of monthly pieces of art is directly tied to the specific market volume of crypto

- Specification of art directly tied to the change of the price of Bitcoin

Bitcoin Bulls and Bears

Art characteristics

01

Each work of art is created by a real-world artist.

02

Incorporated in each work of art is the specific month and year, as well as the corresponding price of Bitcoin at that time.

03

Each work of art depicts a Bull or a Bear with a certain strength level.

04

Each work of art depicts at least one historical event that happened in that specific month.

Bitcoin Bulls and Bears

Reflecting Bitcoin pricing

Each month a pair of unique works of digital art is issued.

A pair consists of one work of art depicting a Bull, and one depicting a Bear.

The strength of the bull and the bear range from 1 to 5. It correlates with the change of Bitcoin trading prices; the more the price goes up, the stronger the Bull gets (and the weaker the Bear) and vice versa.

Bitcoin Bulls and Bears

Incorporating historical events

- Each pair is incorporated with specific elements commemorating one of more notable events that happened in that specific month.

- Events can include landmark moments in the history of Bitcoin, notable launches of companies, projects, media outlets, ecosystem events.

- Founders of the organizations behind these historical events are allocated a complementary pair of Bulls and Bears.

Bitcoin Bulls and Bears

Issuance algorithm

The number of NFT pairs issued in Monthn = Vn / K (but not less than one)

where:

Vn = market volume in Monthn

K = 60

Example:

The market volume in May 2022 was $1354.54 million*. Therefore, the number of new NFT pairs issued for May 2022 would be 1354.54 / 60 = 23.

Exception:

Every month has a minimum issuance of 5 pairs of Bulls and Bears. Except for the year 2010 (only one unique pair per month), and the years 2011 and 2012 (only three pairs per month).

Bitcoin Bulls and Bears

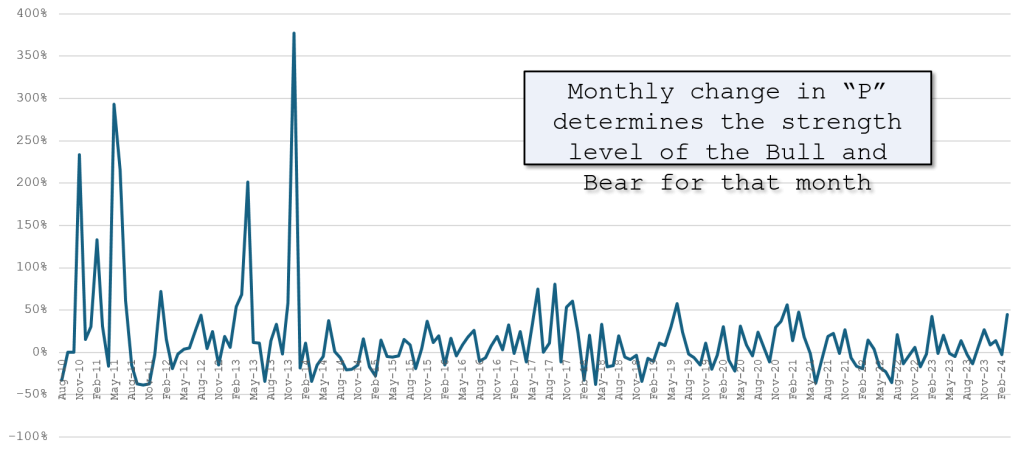

NFT strength algorithm

The strength level of Bulls and Bears issued in Monthn is based on the change in the

Price Index of BTC (P) in relation to the US Dollar, calculated as: (Pn / P(n-1)) – 1)

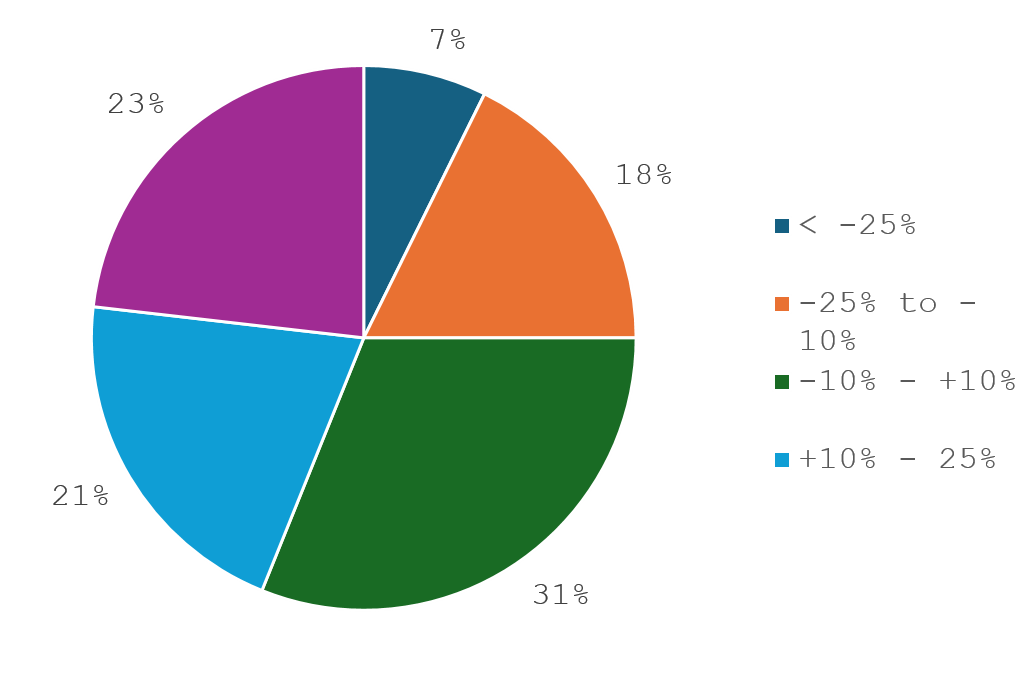

% Change in P

< – 25%

– 25% to – 10%

– 10% to + 10%

+ 10% to 25%

> + 25%

Bull Strength Level

1

2

3

4

5

Bear Strength Level

5

4

3

2

1

Bitcoin Bulls and Bears

NFT strength algorithm (continued)

Bitcoin Bulls and Bears

Frequency of strength distribution

Monthly, from August 2010 until August 2024

Bull Strength

Bear Strength

1

5

2

4

3

3

4

2

5

1

Bitcoin Bulls and Bears

Project phases

Phase 1 (March – September 2024)

- Token design

- Sign the first artists to cover the first batches

- Inventory of notable events and engage specific stakeholders

- Determine launch strategy

Phase 2 (October 2024- July 2025)

- Monthly issuance of 10 batches

- Each batch covers 12 – 23 months

- Each batch represents between 216 and 342 digital works of art

- Public sale of works of art is randomized, but with full transparency of specific months, events, artists, volume per pair

Phase 3 (August 2025 – Onwards)

- Monthly issuance monthly batches

- The number of available works of art is directly tied to the market volume of crypto currencies in the specific month

- The strength of the Bear and Bull is directly tied to the change of the price of Bitcoin in that specific month

- 10% of monthly issuance is held in reserve by the publisher, Satoshi Studios Inc.